Table of Content

We'll help you estimate how much you can afford to spend on a home. Maurice “Chipp” Naylon spent nine years as an infantry officer in the Marine Corps. He is currently a licensed CPA specializing in real estate development and accounting. Nearly all of our clients utilize the zero down payment benefit of a VA loan.

The cost is determined by the VA funding fee rate, which ranges between 1.4% to 3.6% of your loan amount. Borrowers should also consider the impact loan size has on VA funding fees and general loan closing costs. To offset the costs of the loan program, the VA imposes a funding fee ranging from 1.4% to 3.6% of the loan amount. Yes, you can roll this fee into your total loan amount and pay it off over time. But, you should still recognize that, the larger the loan, the larger the VA loan funding fee. Homes are inherently illiquid assets, meaning you can’t quickly convert the wealth in a property into cash.

Business loans and lines

Choosing to refinance an existing loan into a VA loan can cost more than borrowing a VA purchase loan. Here are a few basics to consider while calculating your monthly payments. Eligible Veterans, service members, and survivors with full entitlement no longer have limits on loans over $144,000. This means you won’t have to pay a down payment, and we guarantee to your lender that if you default on a loan that’s over $144,000, we’ll pay them up to 25% of the loan amount. According to 2020 data from Zillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowner's income and the typical local home value.

And recent economic trends haven’t exactly encouraged big-ticket-item purchases. Between high inflation and mortgage rates that have doubled since the beginning of 2022, buying a house can feel like a tough goal to reach on a $100,000 income. Lenders also impose credit score, income, cash-on-hand, and employment history/stability requirements. Borrowers must meet these requirements in addition to the VA ones in order to qualify for a loan.

Other Common Fees Paid at Closing

It is simple to check whether the home is safe for living or not. There are three steps to prove your eligibility for the loan. You must get your COE, satisfy the lender’s requirements, and meet all the MPRs. VA loans are only financed for residential properties, so it is essential to borrow for a property where you know you will be staying for a while. Veterans are in the clear, but if you are an active military member, you might get a PCS. Depending on the benefits available to other service types, a veteran’s loan may differ from a reservist’s loan.

The last way to reduce your monthly payment is by making a downpayment to reduce your monthly expenses and help you save thousands. Candidates who make a downpayment of less than 5% are expected to pay 2.3% of the total loan amount if they are borrowing a VA loan for the first time. For every subsequent use, the funding fee is 3.6% of the total loan amount.

How Much Can I Afford with a VA Loan?

As we mentioned above, VA funding fees can also impact your loan. Unless you are exempt from these fees, you can expect to pay 1.4% to 3.6% of the loan amount at closing. While these fees can be rolled into the loan and paid out over time, you must consider that the larger the mortgage loan, the larger these fees will be. Disability and prior VA loan use are also something you need to consider as they can affect whether or not you will be required to pay a VA funding fee and how much it might be.

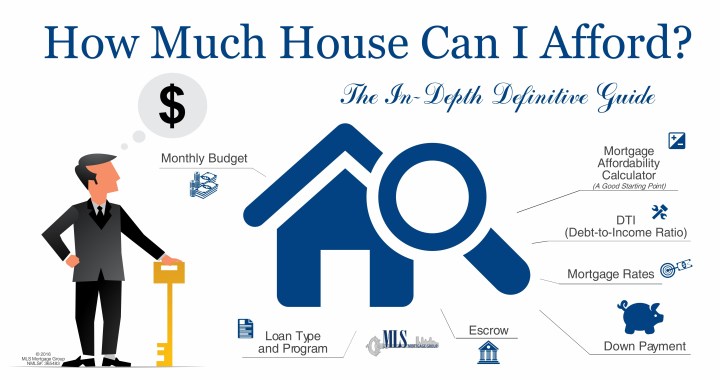

The VA loan affordability calculator is set to the top end of the VA's recommended DTI ratio of 41 percent. Use the following calculator to determine the maximum monthly payment (P+I) and the maximum loan amount for which you may qualify. Down payment requirements can also vary by lender and the borrower’s credit history. The minimum down payment for an FHA loan is just 3.5% with a credit score of 580 or higher, for example, but the minimum is 10% with a credit score of 500 to 579. Department of Veterans Affairs, usually do not require a down payment. VA loans are for current and veteran military service members and eligible surviving spouses.

While the VA program is flexible when it comes to evaluating income and employment, applicants must ideally have at least 2 years of full-time work. If you are a part-time employee or self-employed applicant, the VA usually asks for additional documentation to review your financial background. To improve your chances of approval, it’s best to minimize work gaps and establish a reliable source of funds. To get a general idea of how much owning a home will cost, start by using a mortgage calculator to crunch the numbers.

Generally, homeowner's insurance costs roughly $35 per month for every $100,000 of the home's value. You can edit the calculator's default amount in the advanced options. The most common term for a mortgage is 30 years, or 360 months, but different terms are available depending on the type of home loan that works best for your situation.

It’s beneficial if your current conventional mortgage has a higher rate than a VA loan. VA cash-out refinancing allows borrowers to tap up to 90 percent of their home equity. This limit is higher compared to FHA loans that only allow borrowers to access up to 85 percent home equity.

This is beneficial especially if you can score a low rate while avoiding monthly PMI payments. However, if you have limited funds and can’t qualify for a conventional loan, it’s worth taking a VA loan instead. Just save up for a down payment to reduce your VA funding fee. VA loans require no down payment and come with more tolerant credit qualifying standards.

You should be in close contact with your real estate agent and VA loan lender when putting together a sales agreement. They will provide you the necessary instructions for signing and submitting to the seller. They come with a funding fee, which is paid to support the program. According to the Blue Water Navy Veteran Act, as of January 1, 2020, all applicants with full entitlement will not be restricted to any VA loan limits.

Dollar SignYour debt-to-income ratio helps determine if you would qualify for a mortgage. The Veterans Affairs Department is an agency of the U.S. government. VA loans make home ownership more possible for borrowers than it otherwise would be through conventional mortgage loans, primarily because a VA loan does not require any down payment.

No comments:

Post a Comment